betterment tax loss harvesting joint account

Quickly and easily transfer money between your checking account and Betterment by linking them electronically. Betterments use of tax-loss harvesting is a huge benefit to efficiently use capital losses to offset your tax liability.

Betterment Review 2022 Better Than Wealthfront

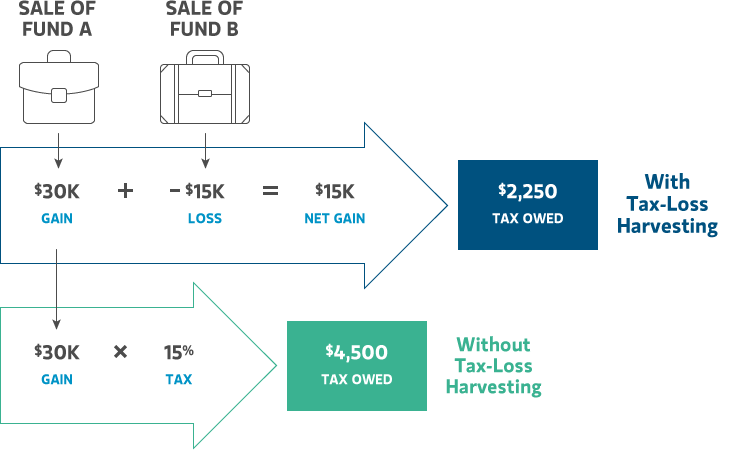

Tax-loss harvesting is when you sell a security at a loss for tax purposes.

. By harvesting this loss you are able to offset taxes on both the gains and income that you make on other securities. There are no minimum balances no transaction fees no holding periods and no hidden costs. Betterment account has fund A 20 B 50 and C 30 I would think that the differences in the allocation would be enough to indicate difference strategies and thus not necessarily substantially identical.

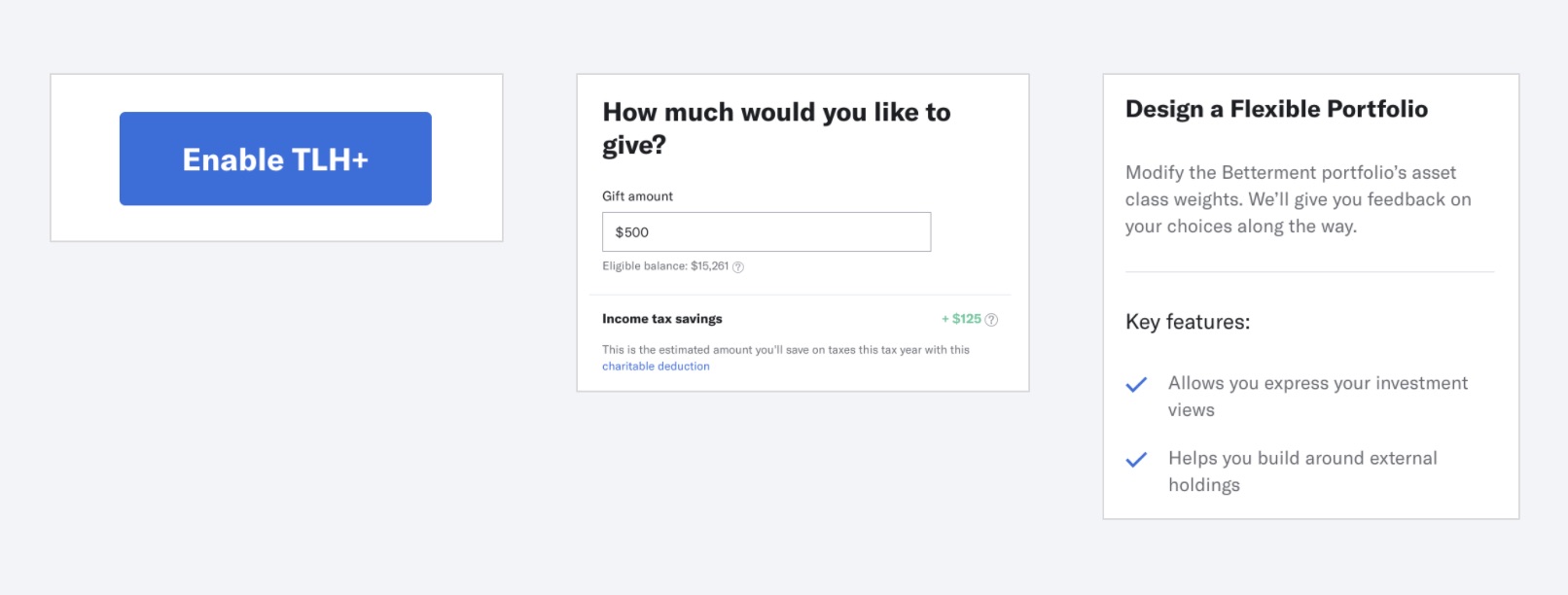

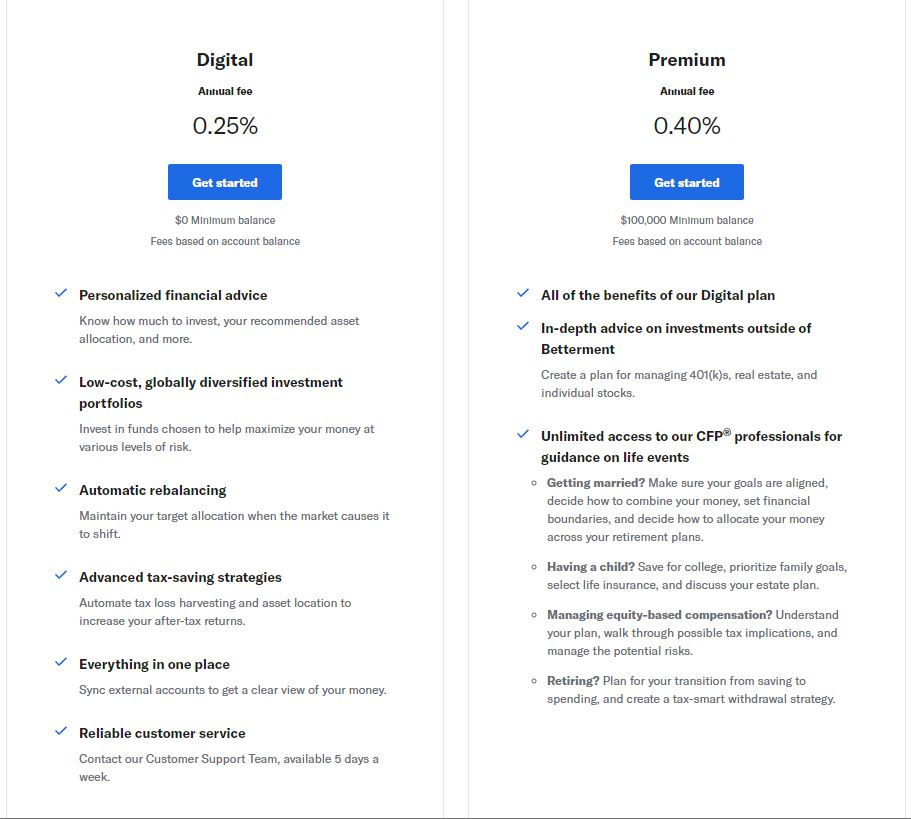

Existing strategy Problem. Betterment is one of many new robo advisor services. They offer an automated tax loss harvesting service TLH as part of their standard management fee for accounts with holdings greater than 50000 including both taxable account and traditional IRA holdings.

We only support joint accounts with rights of survivorship. Betterment performs tax loss harvesting by selling securities that have underperformed in your portfolio and realizing a capital loss. If your joint account is with your spouse and you file your taxes jointly you can enable TLH.

You can use this loss to offset. Any account that is taxable and experiences a capital gain dividend or any interest will be subject to their respective taxes. Do you want access to human financial advisors or is a digital-only option OK with you.

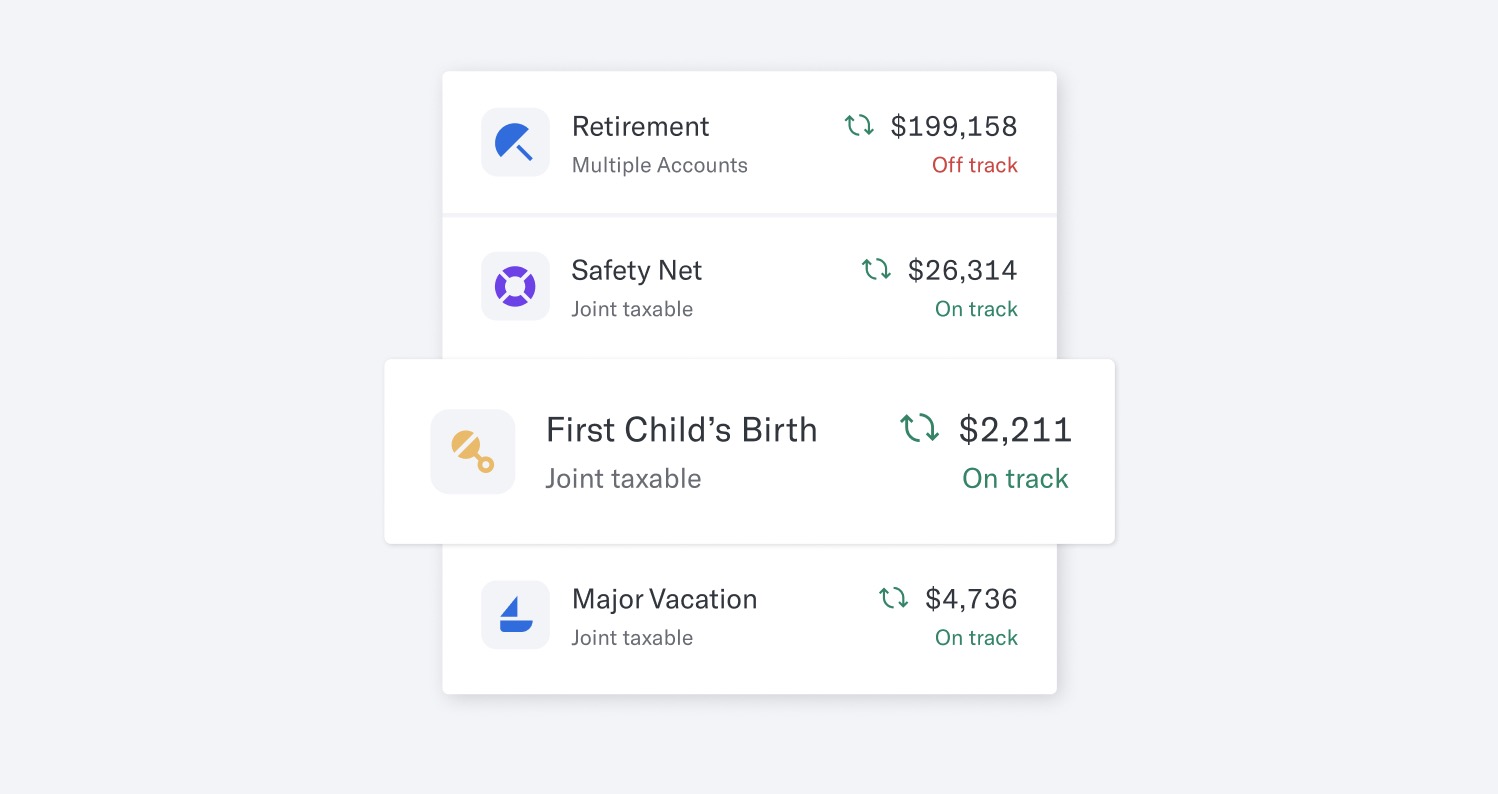

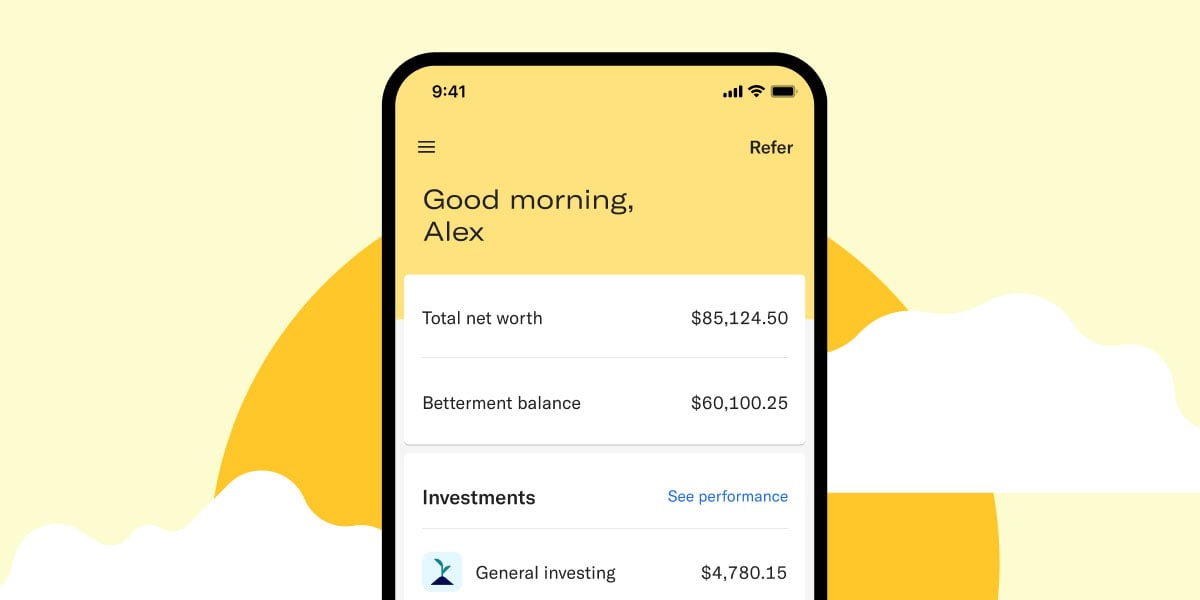

Betterment offers automatic tax loss harvesting but it cannot sync with external accounts Schwab. You are solely responsible for determining whether to. Our joint accounts enable two people to save and progress toward investment goals together.

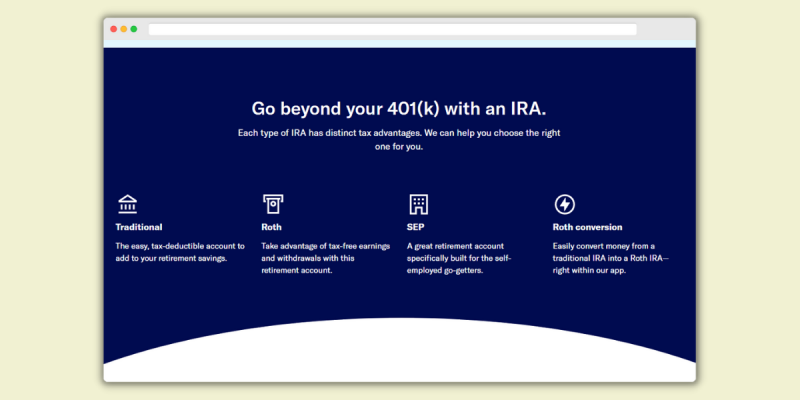

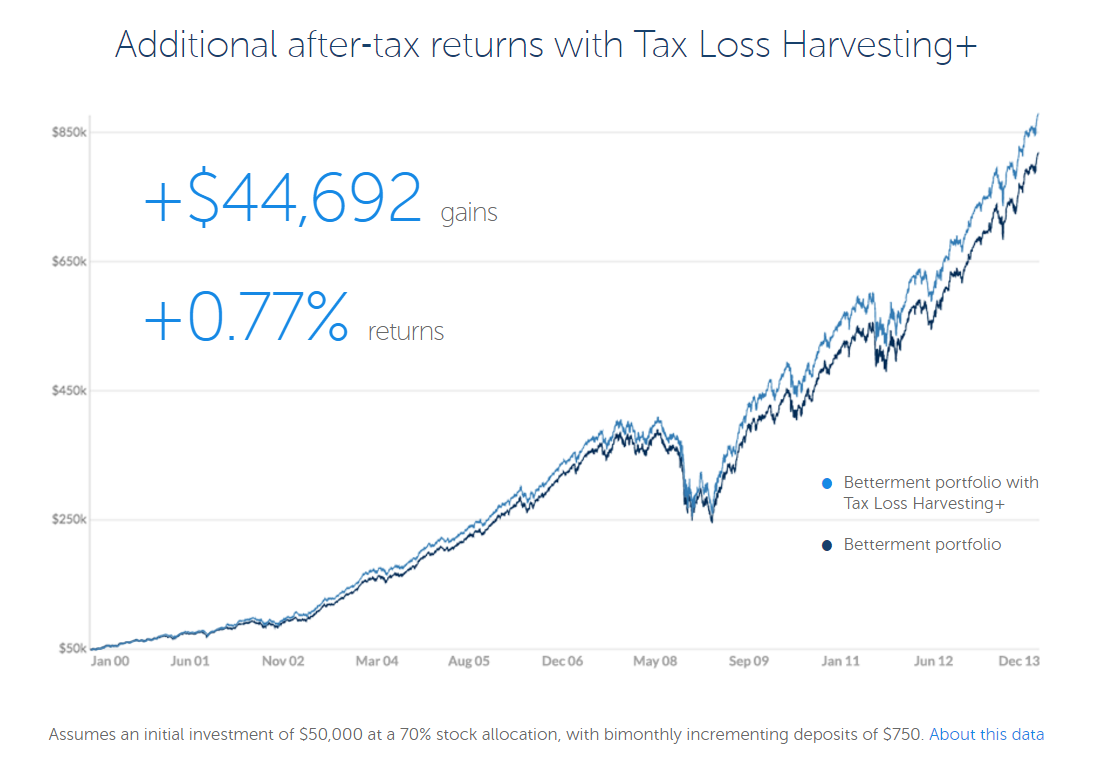

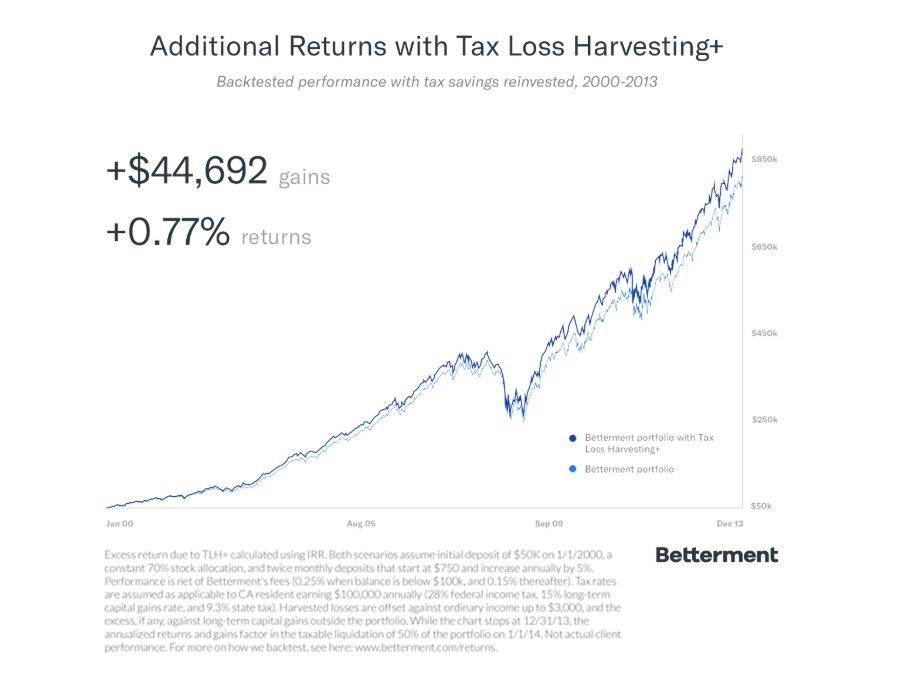

Tax-loss harvesting is not offered for. This year we would like to start investing into taxable accounts after maximizing our retirement accounts. Over 20 years Betterment claims that can add up to an additional 147809 in your pocket versus the governments.

Tax-loss harvesting helps lower your tax burden by reducing your overall capital gains from. My wife and I use Betterment a roboadvisor to manage our IRAs. When you enable TLH on your Betterment account youll be asked for your spouses account information so that we can look across both your accounts for opportunities to harvest losses while seeking to prevent wash sales in your Betterment accounts.

Betterments tax loss harvesting is the practice of selling a security stock bond ETF etc that has experienced a loss. Tax loss harvesting can lower your tax bill by harvesting investment losses for tax reporting purposes while keeping you fully invested. Betterments Tax-Coordinated Portfolio is.

Tax Loss Harvesting Disclosure. For background info tax loss harvesting manufactures losses in your account by buying and selling similar securities. How much do you have to invest.

Must meet 500 minimum to open account and access tax-loss harvesting. When selling an investment that has increased in value you will owe taxes. Wealthfront offers tax-loss harvesting on any taxable accounts with no additional minimum investment needed to access the feature aside from the robo-advisors base account minimum of 500.

And even if your buy is in your IRA or 401K you can trigger a wash sale. However this does not mean you will not owe any taxes. When you enable TLH on your Betterment account youll be asked for your spouses account information so that we can look across both your accounts for opportunities to harvest losses while seeking to prevent wash sales in your Betterment accounts.

This means you show as having a loss for tax purposes and can pay less taxes now. Stock level tax-loss harvesting direct indexing can be selected. Daily tax-loss harvesting free for all taxable accounts.

I have been using Betterment for a while now and my wife and I opened a joint account about two weeks ago. Tax Loss harvesting is the practice of selling a security that has experienced a loss. By realizing or harvesting a loss investors are able to offset taxes on both gains and income.

The sold security is replaced by a similar one which helps maintain an optimal asset allocation and expected returns. Betterment Tax Impact Preview. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency.

Stock level tax-loss harvesting direct indexing can be selected. You could trigger a wash sale simply by re-investing dividends. You should carefully read this disclosure and consider your personal circumstances before deciding whether to utilize Betterments Tax Loss Harvesting TLH feature.

That can help single out tax-loss harvesting opportunities and save investors with taxable accounts a significant amount of money. While Betterment tracks your TLH losses. Sales of a security at a loss are not deductible if you buy a substantially identical stocksecurity within 30 days of the sale.

For details on the operation of TLH you should also read our TLH white paper. Delay reinvesting the proceeds of a harvest for 30 days thereby ensuring that the repurchase will not trigger a wash sale. My 401k is at Fidelity and my wifes 401k is at Schwab.

No matter who you are you get everything for one low transparent fee of 025 4X lower than what youd typically pay for advice. There are rules to prevent doing just that. According to Betterment tax-loss harvesting and tax-coordinated portfolio strategies combined can boost investor returns by as much as 266 annually.

Both holders in a joint account have joint ownership of the assets in the account and are able to create goals transfer funds from the linked checking account make allocation changes and view the account. While its the easiest method to implement it has a major drawback. The IRS knows this strategy can be used to generate substantial phantom tax losses by taxpayers.

Tax-loss harvesting available for any taxable accounts. So for Betterment to do automated tax-loss harvesting in your taxable account without triggering wash-sales Betterment must know all of the securities that you own which is why they are asking. No market exposurealso called cash dragCash drag hurts portfolio returns over the long term and could offset any potential benefit from tax loss.

The IRS knows this strategy can be used to generate substantial phantom tax losses by taxpayers. Youll pay more capital gains hopefully when you sell in the future but the tax benefits you realize now should outweigh the increased. If your joint account is with your spouse and you file your taxes jointly you can enable TLH.

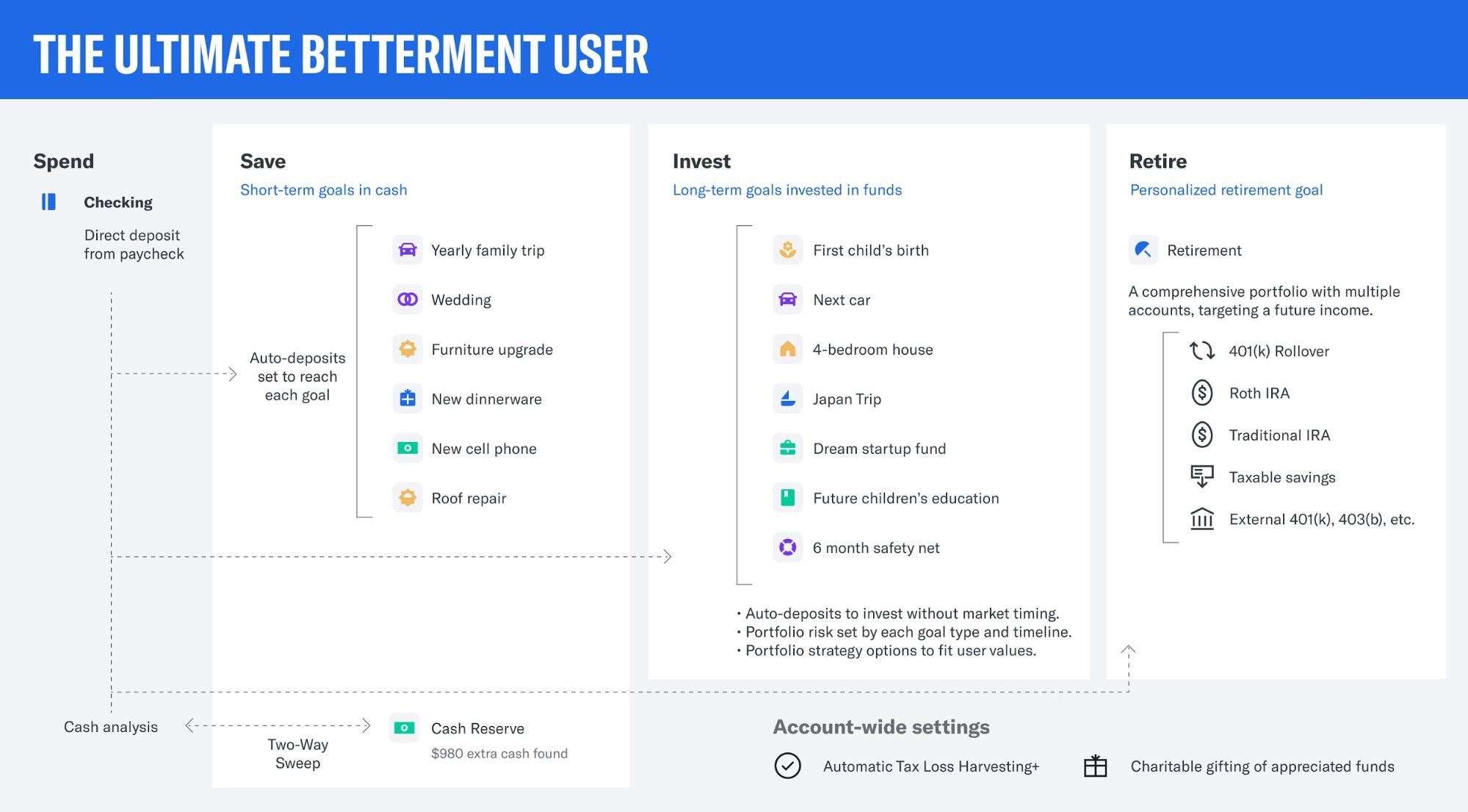

What The Ultimate Betterment User Looks Like

Betterment Review Smartasset Com

Betterment Review 2022 A Robo Advisor Worth Checking Out

Betterment Review Safe Robo Advisor For Beginners

Betterment Vs Acorns Which Robo Advisor Is Best

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

Betterment Review 2021 Investormint

/betterment-vs-vanguard-4f74415b96a34269b6671a8706391df0.jpeg)

Betterment Vs Vanguard Personal Advisor Services Which Is Best For You

What The Ultimate Betterment User Looks Like

Betterment Review Smartasset Com

Betterment Review 2021 The Leading Digital Wealth Advisor

A Detailed Review Of Betterment Returns Features And How It Works

Betterment Review 2022 A Robo Advisor Worth Checking Out

A Beginner Investors Guide To Vanguard And Betterment Two Quality Low Cost Investment Providers So You Can Deter Finance Investing Investing Money Investing

Wealthfront Vs Betterment Which Robo Advisor Is Best One Shot Finance

What The Ultimate Betterment User Looks Like